Case Studies in Banking Sector

According to P&S Market Research, the global robotic process automation market is projected to reach $8.6 billion by 2023. In the banking industry, robotics process automation (RPA) is gaining traction, with adoption rates increasing pace

since mid-2016. And while implementation of this technology is still relatively new in the financial-services sector, there are many processes, operations, transactions, and work tasks which can benefit from RPA.

RoBoost bots can be used, for example, to streamline the firm’s trade-settlement procedures. Tasks include clearing trades, conducting order research, and resolving discrepancies. While human staff require five to ten minutes to reconcile a failed trade, the RoBoost bot can perform the same procedure in a quarter of a second.

Other RPA benefits noted by the bank include an 88-percent improvement in transaction-processing times and account-closure validations—across many different systems—with an impeccable accuracy rate of 100 percent.

The deployment of the RPA bots has allowed banking employees to devote more time to operational quality control and outliers.

consider a quote from the bank’s annual report:

“We have been improving our processes and applying automation tools, such as robotics for routine processing… these tools are increasing efficiency, reducing costs and improving speed and accuracy, which benefits us and our clients. And, our work progresses as we continue to invest in our technology platform and capabilities to advance and enhance our client service.”

Use-case examples in this RPA implementation include automation of a customer account onboarding process. The purpose is to develop a robot that automates the process of transferring information collected during an onboarding meeting between a bank advisor and a customer. Normally, information is first entered into an onboarding platform; next, the advisor types this information into a customer portal platform. The typing and information transfer take’s approximately 20-30 minutes at each meeting.

Upon review of the impact of this RPA implementation, the bank estimated a development period of just weeks—and efficiency savings of six to seven FTEs, equivalent to 27,300 cases per year. Other projected benefits include reduced errors.

Another example is integration of RPA in the process of closing accounts for customers selling a home. The software can be used to “validate if loans have been redeemed and collateral has been deleted” and to complete the closing accounts process and releasing money due to customers. The bank estimates a four-week development period, a return of 1.7 FTEs, and seven months of total time saved.

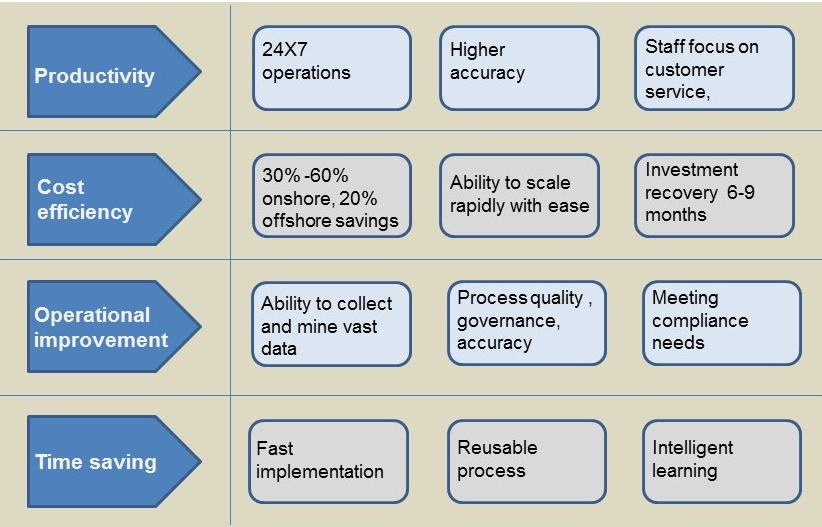

Many Bank are deploying RoBoost RPA to more efficiently manage repetitive tasks. And they have reported 30- to 70-percent automation in areas where the software is integrated—and noted a decrease in the time required for employee training

Many Banks will replace a significant number of jobs with robots, the bank itself has projected that robots are more likely to complement human employees than replace them outright.

A Bank was challenged with finding an efficient solution for moving large volumes of data to its core banking system. After purchasing several branches, the community bank had amassed an additional 20,000 customer accounts and 2,500 loans—all of which needed to be moved into the core banking system. RoBoost’s RPA software empowered the bank to automate processes on a daily, weekly, and monthly basis. For example, it helped the Bank to load and fund 25 to 40 lines of credit, and close and add addendums to 40 to 50 accounts per week.

By deploying RoBoost’s RPA software, the bank was able to reduce the required time for processing lines of credit and addenda from two to three hours to just one hour. RoBoost claims that its software helped this community bank save 900 employee-hours over the course of one year.

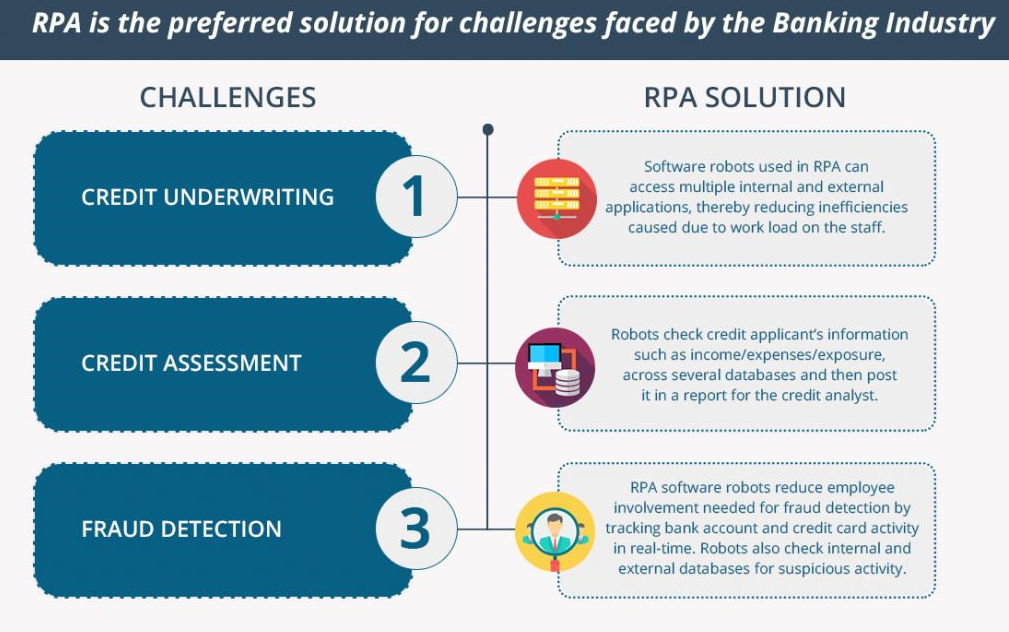

As you can see from the examples above, there are numerous opportunities for RPA in banking. It’s already accelerating the lending process and rendering operations far more cost-effective, saving the banks and their customers time and money.

Additionally, Retail and commercials banks alike are facing increased pressure from management, shareholders, and external competition (such as fintech companies) to reduce costs, increase product quality, and accelerate the processing of back-office work. When paired with the right type of process analysis, robotics can help banking operations management tackle most large-scale and routine data-movement tasks. They can also implement it with unprecedented speed-on the order of weeks, not months or years. The financial benefits of robotics in banking are matched by the improvement it yields in both back-office processes and the customer experience. In short, banks can save money on labor-while doing more with less-with RPA.